SKRILL (Moneybookers) REVIEW

|

Name: | Skrill (Moneybookers) |

| URL: | moneybookers | |

| Address: | Moneybookers Ltd Welken House 10-11 Charterhouse Square London EC1M 6EH England | |

| Location: | United Kindom | |

| Service Hotlines: | 9:00am – 6:00pm | |

| Customer Service tel: | +44 870 383 0232 | |

| UK Phone | 0905 848 0011 | |

| Live Chat: | Yes |

In an online gaming world that has been on a rise in recent years, the online casinos still use some complicated and sometimes frustrating methods of deposit and withdrawal funds. However there is a method that will make your life easy and that requires almost no time and paperwork. This method is Skrill (Moneybookers)

Skrill (Moneybookers) provides a FREE digital wallet (e-wallet). You can use your Skrill account both to instant upload funds to your gaming account and to withdrawal fund from your gaming account. Basically giving you instant and direct access to your money.

For bettors and punters this is a real advantage, because they can instantly withdrawal funds from one online casino account and upload them into another one, free of any charge. Online casino gaming becomes very convenient, faster and safer.

When you upload funds to your Skrill (Moneybookers) account, from a bank account, the transaction will be free of any charge. When you withdrawal funds from your Skrill (Moneybookers) account a small flat fee will apply for each withdrawal. This small fee is there so you will be able to benefit from the other advantages the account provides you.

- You can instant deposits and withdrawals; pay & play. - You get accepted by virtually all online gaming operators. - You get exclusive bonuses. - You get instant access to funds with the Skrill (Moneybookers) Prepaid MasterCard® - You benefit from customer support in 12 languages and 24/7Skrill (Moneybookers) offers you the possibility to become a VIP customer. So if you want to transfer more that €2000 per month, in multiple currencies without ever having to deal with limitations, and to save money on your transaction cost, they the VIP program is for you. This VIP program also includes as a benefit a personal account manager that speaks your language, you can also receive invitations to special events as tournaments and cash back campaigns.

With direct processing and instant payment notifications, excellent customer support and along with zero setup fees or monthly minimums, this service is second to none. Finally, you can also top up your Skype, pay on eBay and use it in more than 70.000 online shops!

Skrill (Moneybookers) Prepaid MasterCard

Click here to get a Skrill (Moneybookers) MasterCard

Skrill (Moneybookers) prepaid MasterCard is a great way to manage and stay on top of your spendings. It gives you instant and direct access to the funds in your Skrill (Moneybookers) account. - The MasterCard can be used in four currencies (EUR, USD, GBP and PLN - You can withdraw cash at over 1.5 million Automated Teller Machines worldwide - You can use the Skrill (Moneybookers) MasterCard at around 28.5 million stores and restaurants - Net+ MasterCard has no credit checks, tie-ins or monthly fees - Net+ MasterCard has no overdraft or late payment fees.

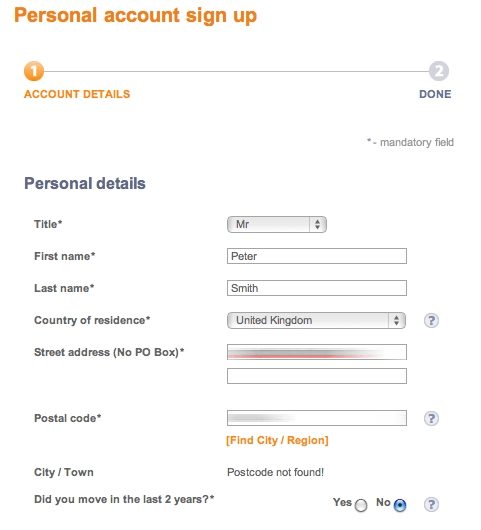

How to open and verify a Skrill (Moneybookers) account.

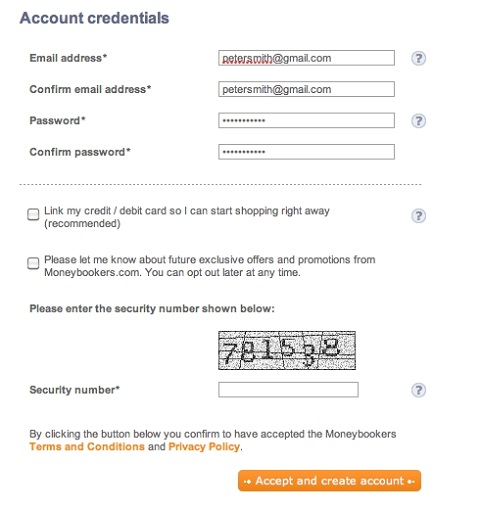

Registering at Skrill (Moneybookers) it is very easy and will only take a few minutes of your time. Just follow the steps shown on the below model. Sign-up here.

After you register if you want to upload funds to your account, you must take another step and verify your account. This step purpose is for Skrill (Moneybookers) to ensure that you are the account holder, they will send you an e-mail, with a verification code. The code must be used to activate your account.

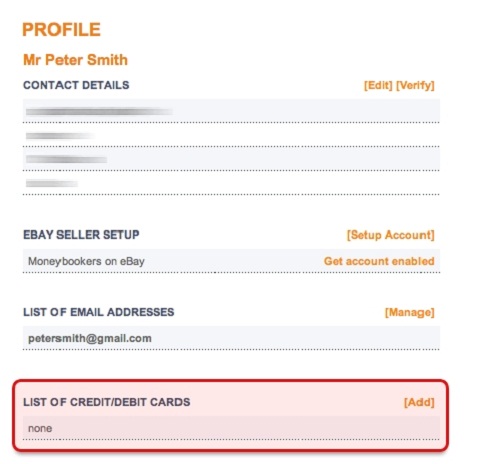

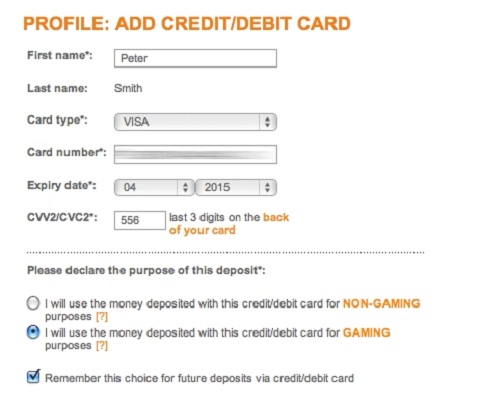

After registering and activating your account, you can choose to register a credit/debit card to your Skrill (Moneybookers) account. To register your credit/debit card Skrill (Moneybookers) will withdrawal an amount of €1.01 to €2.99. To register your credit/debit card to your Skrill (Moneybookers) account just follow the steps shown below:

If you are verifying a bank account (not a card) the process is practically the same. It is just that you need to enter the code of the transaction (not the amount deducted).

Once your account has been verified you may start using your account to send and receive funds online. Receiving funds to your account is free of charge and usual fees for making a withdrawal is generally €1.80 for bank transfer and €3.50 with a check. The verification process also allows your account's limits to be raised.

Is Skrill (Moneybookers) safe?

Absolutely yes, Skrill (Moneybookers) is regulated by the British Financial Services Administration FSA. This means that they have to comply their service with a huge set of some of the most stringent requirements concerning risk prevention and consumer protection. For financial transactions, Skrill (Moneybookers) employ a powerful 128-bit SSL technology, the same kind of SSL technology that the banks use for their online operations. Skrill (Moneybookers) is one of the most secure online funds transactions platform because they never reveal personal and sensitive information to any one, not even the person you transfer funds to. Click here to register at Skrill (Moneybookers)

Can I have several accounts?

This is out of the question, Skrill (Moneybookers) makes sure that every customer has only one account, this is a money laundering and fraud prevention method.

Can I send money abroad?

Definitely yes, Skrill (Moneybookers) is in fact one of the most cost efficient and safe way to send money abroad.

Can money be sent to a person who does not have a Skrill (Moneybookers) account?

Definitely yes, you can send money to a person that doesn’t have a Skrill (Moneybookers) account, however that person has to create an account in order to cash out.

How much their services cost?

When you use Skrill (Moneybookers) costs are more than reasonable. Uploading funds from your bank account to your Skrill (Moneybookers) account is free of any charge. Receiving and requesting money is free as well. If you use a credit card to upload funds then you will have to pay a 1.9% fee. When you send money to someone you will pay a 1% fee. Withdrawal from your Skrill (Moneybookers) account to your bank account will cost you €1.8 also if you withdraw using a cheque, you will pay a flat fee of €3.5.